denial Services

Denial services

Denial of medical claims is one the biggest concerns for doctors, physicians, and other healthcare professionals. A medical facility can easily experience initial denial rates of 7-10% of its claims although a common best-practice recommendation is to hold the denial rate to 5% or less. For many organizations, such denial rates could often lead to operational losses from which they would never recover again.

Umed’s denial management services are designed to sift through your data in order to uncover the root cause for all denials. Our team analyses, and reports denials, identifying unpublished rules and recommending fixes for individual denied claims while helping you identify and implement process improvements to eliminate recurring denials and optimize revenue.

Our denial services Include

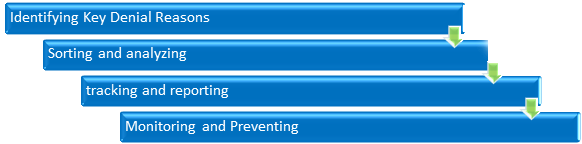

Identifying Key Denial Reasons

The first step we undertake is to identify the key reasons for the claims denial. When claims are returned unpaid the payer will get a status code as well as the reason for the remittance. We understand the frequent and hidden reasons behind constant denials that may require complete examination of your billing procedures and management. After this is done our team knows exactly where we should look for and fix the issue for faster reduction in denials and effective claims management.

Sorting and analysing

After identifying the denial volume and reasons, our next step is to categorize the denials so that they can be monitored and routed to the appropriate department for remediation. Sorting and analyzing denials by category will help identify opportunities to revise processes, adjust workflows or re-educate employees, physicians and clinicians.

Tracking and reporting

After categorizing the reasons for denial, we develop a tracking/reporting mechanism in which we determine the top denial categories that is impacting the organization and departments/service areas that are impacted by denied claims.

Monitoring and Preventing

Denial management program is an ongoing process that must be continuously monitored and assessed to prevent repetitive errors which will impact revenues. Our denial management experts help to create a team that can analyse denial information and focus on a specific denial category.

Why Choose Umed for Denial management Services?

Umed understands the various causes of claim denials that can increase long-term efficiency and drastically reduce lost revenue. Our medical billing application can help you efficiently analyze and advice about the opportunities for effective denial prevention, which helps all users with a single, on-demand view for managing all aspects of claim denials and receipt of re-submission.

- Manage claims denials from all payers

- Drive initial denial rates below the industry best practice of 5%

- Provide quality services at cost-effective rates within a quick turnaround time

- Provide key trending reports to measure the impact of process improvements

United American Equipment and Medical Supplies have been providing medical denial management services all across UAE at very cost-effective prices. We guarantee to bring down your number of denied claims within a quick time. Contact us for any kind of assistance in medical billing denials and solutions, and we will be more than happy to help you out.

Denial And Underpayment Management:

As a financial executive for a hospital or health system or their employed practice, medical claim denials are constant headaches that negatively affect your organization’s revenue, cash flow, and operational efficiency.

We follow below step by step procedure and get started with determining those under paid claims:

Determine the top procedures and consultation codes

Discuss with biller to provide the top fifteen most performed procedures and consult codes.

Confirm the agreed upon rates:

It’s not possible to determine underpayments until you know how much you are

supposed to get paid. We verify your contracts or ask the insurances you are participating with, to provide the fees schedule for fifteen most performed procedures. Fee schedules for Medicare and Medicaid are publically available here.

Commercials may take time to respond but with regular follow ups, will eventually process your request.

Appeal on those claims

For historic claims; send appeals to carries with a copy of the fees schedule. In cases where carriers adamant on not reimbursing correctly, speak to the medical director on the carrier side and aggressively pursue correct reimbursements.

Major reasons of medical billing claims get rejected

Every healthcare provider strives hard to appoint medical billers who are excellent in their job, isn’t it? Well this is for one selfish reason and that is to ensure their staff work accurately on the daily claims and further speed up the billing process to ensure uninterrupted cash flows for the business. Well no matter how accurately the medical billers do their jobs, there would always be some instance when the provider will come across rejected claims too. There can be number of reasons for such rejected claims, sometimes because of the insurance company and sometimes because of inaccuracy on the part of the in-house billers. Here are seven common reasons why medical billing claims get rejected.

Improper Or Invalid Codes

There are certain codes which require special attention when the claims are made.

Diagnostic code (ICD-ͳͲ code) and procedure code (CPT code) are some of the examples. These are very important codes and when they are missing, incomplete, invalid, or do not related to the treatment provided by the physician, the claims are rejected by the insurance company.

Preauthorization / Authorization

For many insurance plans preauthorization is a must. If the healthcare provider provides services without proper authorization the claims get rejected.

Patient Changes the Insurance Plan

When a patient changes his or her insurance plan, the provider needs to network the new plan to the system and also get a new preauthorization done for the patient. If the provider fails to do so, the claims get rejected.

Cross check the reimbursement rates

With the fee schedules provided by carriers, cross check each claim against the reimbursements stated in the fee schedule.

Flag discrepancies

Build a process to identify underpaid claims regularly. Create automated scripts or partner with companies to review each check, electronic payment and remittance advices on everyday basis. Flag the discrepancies and have your accounts receivables team work on such claims the same day.

Check for opportunities of negotiation

While revisiting your contracts, check when the last time you negotiated on reimbursement rates was. Most commercials allow for contract negotiations every three years.

While practices do and should spend the major portion of their time providing quality care to patients it’s equally important to keep a tab on internal processes. If reimbursements fall then sustaining the business will become difficult.

Considering the risk associated consider outsourcing your medical billing services to experts. Partner with UMEDuae now, as we can give you a team of the most experienced professionals who can handle your revenue cycle management excellently. Contact Us for Medical Billing Services now.

Delay in Filing the Claim

On a general basis the insurance companies allow a period of Ͳ to ͻͲ days to file the claim from the time of service. But certain time when the claims are not filed within the stipulated period or long after the date of service, they end up getting rejected.

Policy Lapse

This is a very common reason, when the patient’s policy gets lapsed the patient is no longer covered under insurance. In such case the claim gets denied. This problem does not come into notice easily as many patients don’t know that their policy is no longer valid.

Provider Not Panelled With The Insurance Company

There might be cases where a provider sees a patient whose insurance plan is not

panelled with the provider. In such case the claim gets denied.

Lost Claim

- A. It doesn’t matter who replaced it, but if the claim gets misplaced and doesn’t make it to the insurance company’s system on time, the claim will be rejected.

- B. There many more reasons associated with the rejection of Medical Billing